ACE & Company

Delivering repeatable returns across private equity

ACE's investment offering has proven resilient over fifteen years, benefiting from the shared knowledge across strategies to make well-informed decisions and mitigate risk. ACE delivers differentiated returns through the breadth of our portfolio, investment process, and information advantage built on decades-long relationships with industry leaders.

ACE’s entrepreneurial approach leverages diverse investment sourcing channels and a large global network. ACE benefits from a longstanding, strong track record since the Company was founded in 2005 and FINMA-authorized in 2017.

ACE’s priority is to deliver investors a trustworthy investment offering that values honesty, transparency, and rigorous execution. With headquarters in Geneva and offices in London, New York, and Cairo, our global presence allows us to maintain proximity to investors, corporate partners, and entrepreneurs.

ACE in Numbers

Driven By Knowledge

- Mitigating risk across stages through our portfolio's breadth of knowledge and depth of expertise

- Engaging our three strategies to foster a more comprehensive understanding of private markets and enhance decision-making

- Drawing on a network of specialists, we gain unique perspectives to make better-informed decisions

Agility as Strength

- Navigating the ever-changing investment landscape by leveraging years of team experience

- Fostering innovation and enabling quick decision-making with an entrepreneurial mindset

- Embracing flexibility to swiftly respond to market shifts and capitalize on emerging opportunities

Aligned Partners

- Demonstrating commitment through ACE partners and employees contributing ~35% of total AUMs

- Fostering a collaborative culture and valuing partnerships with colleagues and investors

- Remaining investor-focused and quickly adapting to an investor’s needs and requirements

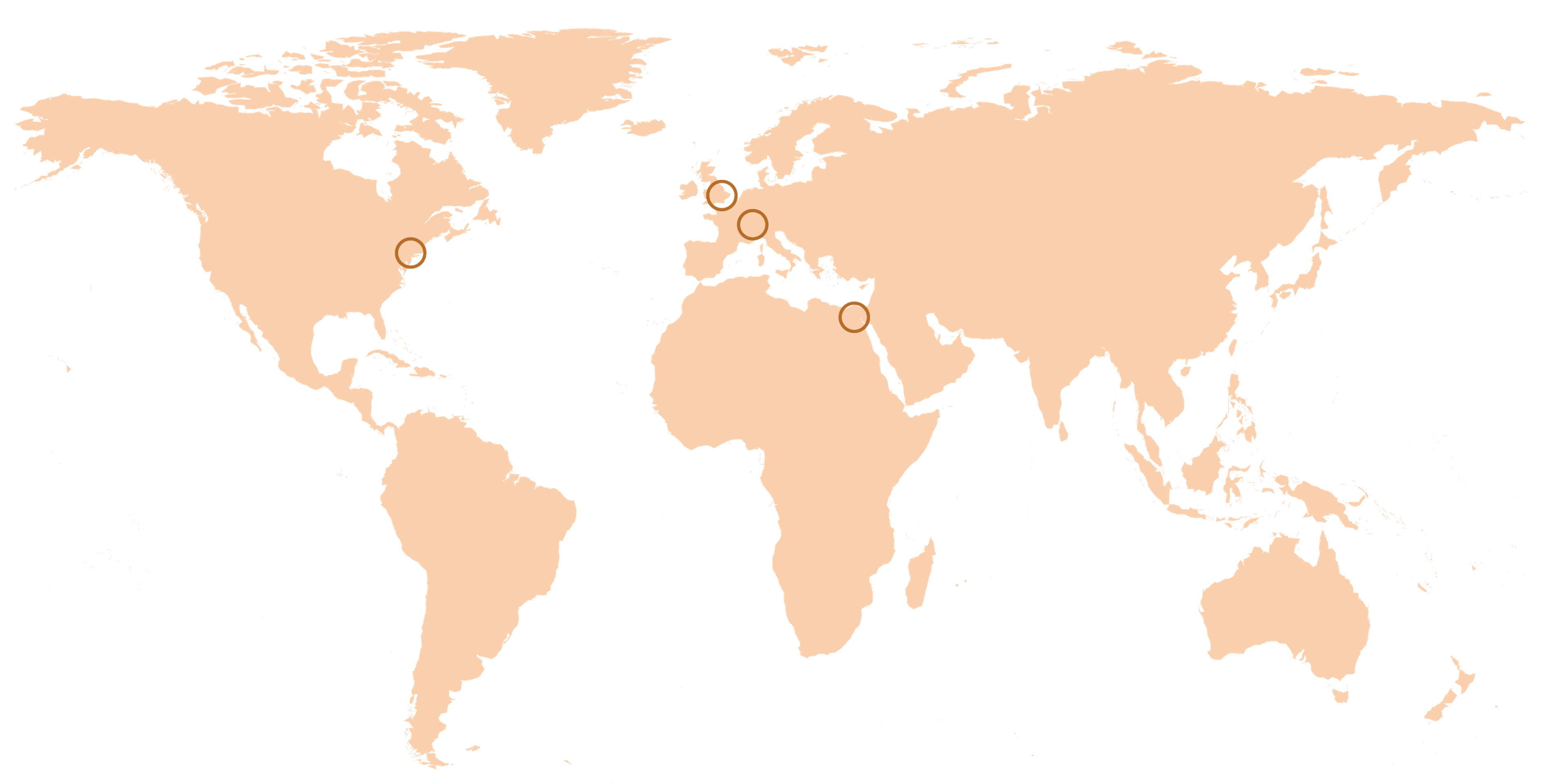

International Footprint

North America

Office in New York

91 Investments

72% AUM

47 exited companies

- Communication Services (1.7%)

- Consumer Discretionary (16.6%)

- Consumer Staples (1.0%)

- Financials (12.2%)

- Health Care (13.3%)

- Industrials (23.6%)

- Information Technology (29.4%)

- Materials (2.1%)

Europe

Office in Geneva

57 Investments

20% AUM

8 exited companies

- Communication Services (7.7%)

- Consumer Discretionary (15.2%)

- Consumer Staples (5.3%)

- Financials (18.2%)

- Health Care (2.0%)

- Industrials (1.3%)

- Information Technology (46.5%)

- Materials (1.4%)

- Hardware & Deep Tech (2.5%)

- B2B Software (0.1%)

Asia

10 Investments

4% AUM

5 exited companies

- Consumer Discretionary (79.6%)

- Financials (4.4%)

- Industrials (2.4%)

- Information Technology (13.6%)

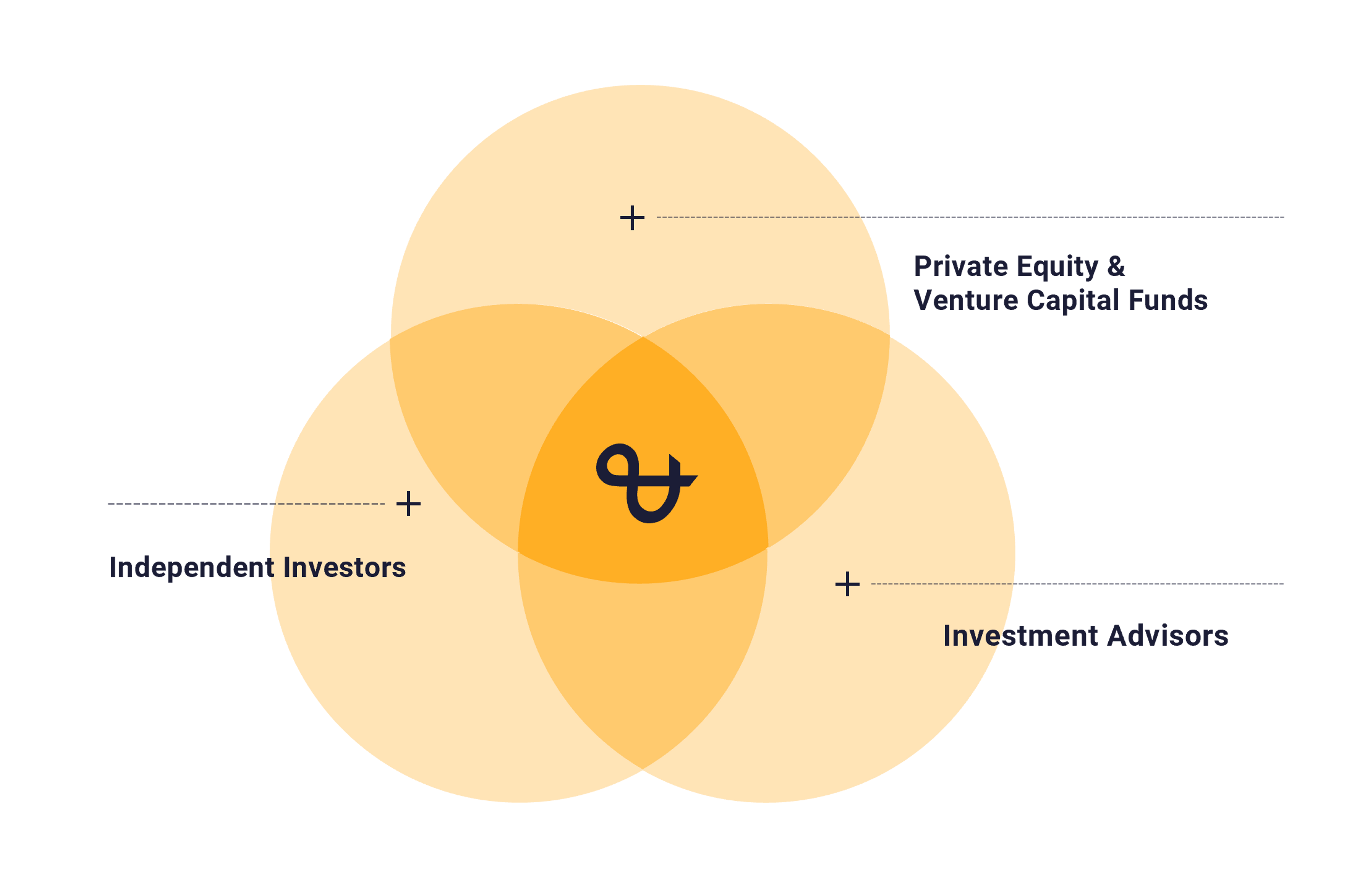

Strategic Positioning

ACE is strategically positioned between private equity and venture capital funds, independent investors, and investment advisors and can understand clients’ needs and provide relevant products and services in response.

Alignment Of Interests

Founded by private investors, a proprietary capital approach to investing is firmly anchored across the firm.

Diversification

ACE’s geographic reach and broad network of investment partners provide access to best-in-class opportunities.

Specialization

With over 18 years of operating experience, ACE has gained substantial experience executing successful direct investments.

Value Propositions

ACE’s value proposition is differentiated within the private equity ecosystem, offering value to various market participants.

To Investors

To Sponsors

Executive Committee

Provide direction on the Company’s strategies, development, performance, and risk management.

Sally Beh (C), Mazen Daou (VC), Sherif El Halwagy, Steve Salom, Audrey Dumas, Mouaffac Al Midani, Lee Lowicki

Investment Committees

Review initial assessments and investment reports, and recommend investment and exit decisions to the Executive Committee

Early: Charles Lorenceau (C), Steve Salom (VC), Sally Beh, Rob Callahan, Adam Said (NV)

ASTO (ACE Swiss Tech Outliers): Charles Lorenceau (C), Steve Salom (VC), Mark Kornfilt, Sally Beh, Adam Said (NV)

Mature: Youssef Haidar (C), Rob Callahan (VC), Sherif El Halwagy, Charles Lorenceau, Adam Said (NV)

Risk & Audit Committee

Assess the group’s risk management, compliance, legal and regulatory requirements. Review the adequacy and integrity of the financial reporting process.

Philippe Jacquemoud, Abir Oreibi

Valuation Committee

Review and approve the valuation policy in accordance with International Private Equity and Venture Capital Valuation (IPEV) Guidelines and industry standards.

Audrey Dumas (C), Antoine Meunier, Sebastien Tatonetti

Our Management Team

Our Strategies

ACE offers three core investment strategies across the stages of private investment: Secondaries, Buyouts, and Ventures. Our portfolio construction guidelines ensure that our investors access the necessary customization to achieve their risk and return requirements. ACE aims to drive returns by managing risks and strategically adjusting investment exposure to the stage of a company’s development. We strongly believe that diversification and sizing of investments according to the risk profile are the most effective approaches to investing private capital. ACE’s specialized investment teams provide the support to create long-term and sustainable investment results.

Secondaries

Buyouts

Ventures

Investment Solutions

Besides its commingled funds, ACE manages separate accounts and opportunistic “club deals” both on a discretionary and advisory basis.

Separately managed accounts are tailored to meet specific client requirements. ACE’s Investment Solutions team can structure, construct and manage a portfolio of private assets on a client’s behalf. Clients have the flexibility to participate actively in every stage of the investment cycle or grant ACE complete discretion over their portfolio.

Thanks to long-standing relationships with top-tier managers around the world, ACE offers access to funds and opportunistic direct opportunities when they arise.

Disclaimer

ACE & Company SA (“ACE”) is a limited liability company authorized and regulated by FINMA (Swiss Financial Market Supervisory Authority), and its subsidiary ACE & Company New York, Inc. as a Registered Investment Adviser by the SEC (Securities Exchange Commission). ACE is a holding company with operating subsidiaries providing investment research, consulting, due diligence and financial services, each subject to the laws and regulatory regime of the jurisdictions in which it operates. The subsidiaries may not necessarily be registered with any financial regulatory bodies. ACE may not achieve all of the expected benefits of our strategic initiatives. Factors beyond our control, including but not limited to the market and economic conditions, changes in laws, rules or regulations and other challenges discussed in our public filings, could limit our ability to achieve some or all of the expected benefits of these initiatives. The positions in companies mentioned herein may be liquidated, without prior notification, even after we have made positive comments regarding the investment. We will not advise as to when we decide to sell, and do not and will not offer any opinion as to when others should buy or sell; each investor must make his or her own decision based on his or her judgment of the market. The information provided herein is solely for informational purposes and does not constitute or form part and should not be construed as an offer to sell or issue or an attempt to solicit new clients or advertise our services for hire in any jurisdiction. No part of this document, nor the fact of its distribution, should form the basis of, or be relied on in connection with, any contract or commitment or investment decision whatsoever. The information and opinions contained herein have been compiled or arrived at in good faith from sources believed to be reliable. No representation, warranty or undertaking, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information or the opinions contained herein. None of ACE or any of its affiliates, advisors or representatives shall have any liability whatsoever (in negligence or otherwise) for any loss, howsoever, arising from any use of this document or its contents or otherwise arising in connection with the document.